What is the Price Action Strategy?

It is one of the important trading techniques used by traders. Traders will draw different patterns in a particular time frame once the pattern is a breakout or break down by a huge momentum in share price they will enter the trade and they book profit from that. This technique will be accurate most of the time. For this technique, we will not be considering any of the fundamental analyses and other technical analyses. Here the complete action is based on the movement of price. In this blog, we are going to learn the 10 most used price action strategy

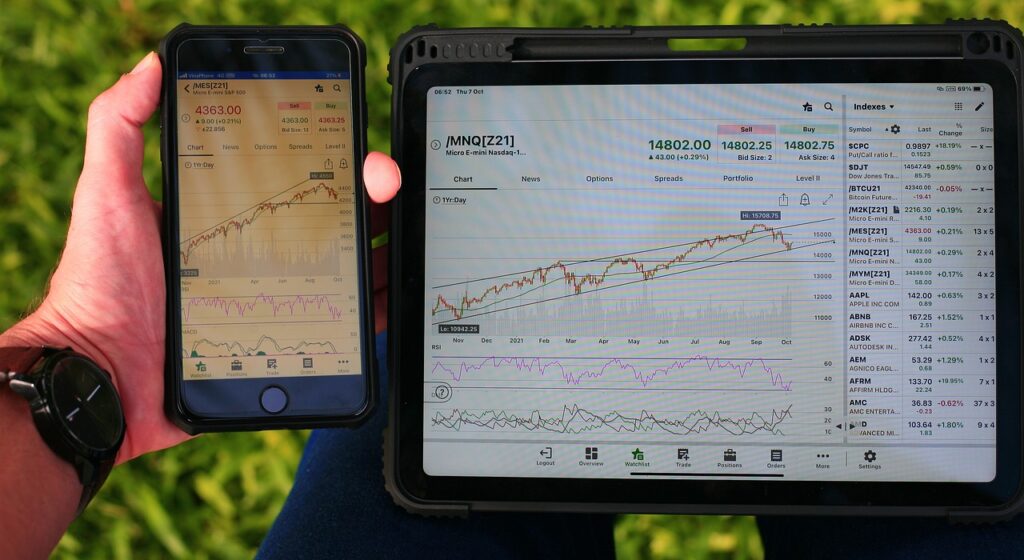

In price action, we look into the price of the stock or options. we can draw candle stick patterns and chart patterns for analysis of the market. We have already covered some of the candlestick patterns here we are going to learn chart patterns and how we can analyze that patterns.

Chart Patterns in Price action strategy

Chart patterns are used to identify the movement of the market and it is completely based on the price. We can divide the chart patterns into three different categories

1) Trend reversal chart patterns

Trend reversal patterns are those patterns from which we can identify a change in the direction of the movement of price. if the market is forming this kind of pattern we can expect a trend reversal. if the market is in an uptrend then this kind of chart pattern is formed it indicates the market is going move towards a downtrend. The opposite will happen in the case of a downtrend.

2) Trend continuous chart patterns

If the market is in an uptrend or down trend, once this kind of pattern is formed it will continue in the same direction. if it is an uptrend you can expect movement toward an uptrend. if it is a downtrend you can expect some movement toward a downtrend.

3) Bilateral chart patterns.

This kind of pattern won’t give any directional movement. once the pattern is formed then we need to wait to get the proper movement then we can enter into the trade. this kind of pattern is a most confusing pattern, the best method is to wait to get any directional movement so you can enter into a profitable trade

1) Trend reversal chart patterns in price action strategy

Trend reversal patterns will help you to identify the market reversal. If this kind of pattern forms we can expect a trend reversal

- Double Top pattern

- Double Bottom pattern

- Head and shoulders pattern – this will occur in an uptrend. once the pattern breakout you can expect a reversal in trends.

- Inverse head and shoulders pattern- this will occur in a downtrend once the pattern got breakout you can expect a trend reversal in trends.

- Rising wedge pattern

- Falling wedge pattern

2) Trend continuation chart pattern in price action strategy

This is one of the most useful and commonly find patterns in price action strategy. This pattern indicates the trend continuation. Before the breakout or breakdown market will be in the consolidation stage. Once the market gives a breakout or breakdown you can enter into the trade. There are different trend continuation patterns that can find in the price action. Here you can find the commonly used patterns and their breakout or breakdown direction.

- Bullish Rectangle pattern

- Bearish Rectangle pattern

- Bullish pennant chart pattern – Bullish pennant is different from the symmetric triangle. It has a long flag pole in the pattern so we can’t consider as a symmetric triangle.

- Bearish pennant chart pattern — Bearish pennant is different from the symmetric triangle. it has a long flag pole in the pattern so we can’t consider as a symmetric triangle.

- Flag continuation chart pattern

- Cup and handle chart pattern

3) Bilateral chart patterns in price action strategy

One of the important bilateral chart patterns is the Triangle pattern. There are three types of triangle patterns are available.

- Ascending triangle pattern — drawing lines through connecting the same highs and Higher lows

- Descending triangle pattern — drawing lines through connecting the same lows and lower highs

- Symmetrical triangle pattern- drawing lines through connecting lower highs and Higher lows

from this pattern, we can’t predict the movement of the stock. it can move to an uptrend or it can move to a downtrend. So we need to wait for the pattern to give any breakout or breakdown. Once we got the confirmation we can enter into the trade. You can use different time frames to identify the trend in the market. in intraday, you can choose 5 minute or 15-minute time frame for the pattern identification.

Conclusion to price action strategy

A price action strategy is one of the best techniques to make money from the market. you don’t need to do any kind of fundamental analysis or technical analysis to take trade using price action. If you are following a price action strategy you need to have more patience. because forming a particular pattern will take time and we don’t know at what time the chart will form.

for safer trade you can combine any of the technical indicators to confirm the breakout or break down happened is a valid one. some times market will retest so if you are using indicators you can avoid that kind of trade. Once the breakout or breakdown happens wait for the candle to finish and try to enter the next candle.

You should follow the strict price action and wait for the pattern for the form. you should target the high-probability trades, don’t take an entry when you have a confused state. it may affect your trading. Don’t be greedy and follow a trading setup.

if you didn’t get any confirmed pattern then you should avoid trading on that particular day. it’s not necessary to trade every day. if you follow the price action method along with indicator confirmation, in a single trade you can double your capital.

Disclaimer: This is for educational purposes and only to understand the concepts.